IGNITE YOUR WEALTH. IGNITE YOUR FUTURE. IGNITE YOUR LEGACY!

LET'S GO!!!

Veterans, are you ready to GET ON F.I.R.E. and take charge of your financial future?

Imagine a life where your finances are secure, your assets are protected, and you have a legacy you can pass down with pride.

This isn’t just about saving a few dollars; it’s about total empowerment.

It’s about owning your financial story and rewriting it with a future that works for you!

The truth?

VA Life Insurance alone might not be enough to provide the stability, growth, and flexibility you need.

While VA benefits are helpful, they can have limitations on coverage amounts, living benefits, and financial growth opportunities.

Many veterans find that VA insurance simply doesn’t offer the flexibility and wealth-building potential needed to thrive in civilian life.

Let me let you in on a little secret…

You may think it’s too late because of your age or because of missed opportunities—but it’s never to late to learn. It's never too late to take action and make better decisions for you and your family moving forward.

Creating wealth and securing your future doesn’t have to take years.

You don’t have to sacrifice endlessly or feel like financial security is out of reach.

All it takes is the right strategy, a little F.I.R.E., and a mindset that’s ready to protect and grow.

I’m here to show you how, and it’s FREE!

Join Me in This Powerful Webinar to Get On F.I.R.E. and Transform Your Financial Future

We’re going to talk about:

- Why VA life insurance or your current insurance may fall short when it comes to protecting your assets and income

- How inflation, taxes, and risk can eat away at your wealth and how to combat them

- Wealth-building tools tailored for veterans who want to preserve their legacy and secure a lasting future

This is for you if:

- You’re a veteran who wants more than just the basics—you want true financial freedom

- You’re ready to take control of your financial story and make the most of what you’ve earned

- You’re tired of limited options and want strategies that work for your life goals

If you are ready to unlock financial security, grow your wealth, and take charge of your future...

Reserve your spot now, and get ready to Get On F.I.R.E.! Don’t settle—create the financial future you deserve.

Financial Growth

Building wealth steadily and sustainably, so your assets work for you over time.

Through smart strategies like compound interest and tax-advantaged savings, you can grow your resources without losing value to inflation or excessive taxes.

This approach ensures that you’re not just earning but accumulating and preserving wealth, creating a solid financial foundation for you and your family’s future.

Financial Protection

Safeguarding your income, assets, and investments from potential risks like inflation, high taxes, and unexpected life events.

Putting safeguards in place, such as cash value protection plans with living benefits, can create a safety net that shields your wealth from sudden financial strains.

This protection ensures that your hard-earned resources remain secure, providing stability and peace of mind for you and your loved ones.

Legacy

This is about creating a lasting impact that extends beyond your lifetime, providing security and opportunity for your loved ones.

By building and preserving wealth strategically, you can ensure that your financial resources support your family’s future needs, dreams, and stability.

A strong legacy means that the wealth you accumulate continues to make a difference, empowering future generations and reflecting the life you’ve built and the values you hold dear.

Tax Efficiency

Tax efficiency is the key to maximizing your earnings and minimizing what you lose to taxes over time.

Using tax-advantaged financial tools, such as cash value protection plans, you can grow your wealth without being heavily taxed on gains.

This approach allows you to retain more of your income, making your money work harder for your long-term goals.

Financial Flexibility

Financial flexibility means having access to funds when you need them most, without rigid restrictions.

With cash value plans, you can tap into your savings for emergencies, health needs, or major life goals, all while maintaining the overall integrity of your wealth.

This flexibility provides the freedom to respond to life’s changes confidently, knowing you have reliable financial resources at your disposal.

This webinar will be a game-changer!

I would never ask you to spend an hour with me and NOT make it one of the most impactful, eye-opening, breakthrough-filled experiences you've ever had.

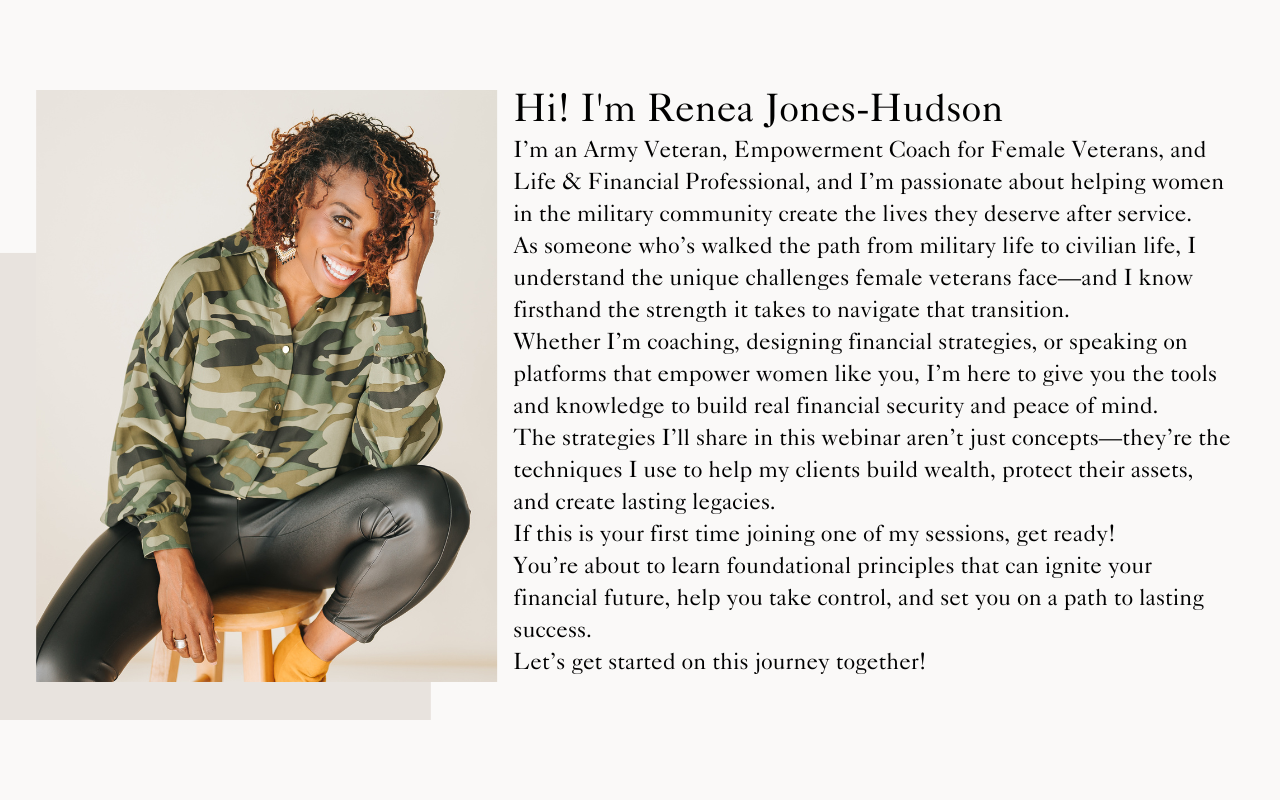

My mission is to educate, enlighten and empower you with clarity and confidence to transform your financial future in ways you never thought possible.

This isn’t just another webinar—it’s your next step toward financial empowerment and financial freedom!

This was really great information!

As a veteran, I felt overwhelmed by financial planning, and I still had old beliefs about the value of life insurance but I appreciate you Renea, thank you for enlightening me on Cash Value Life Insurance and Living Benefits.

I now have a better understanding of the value of Life Insurance. I left with a clear plan and newfound confidence in my financial future!

— Ashley T., Army Veteran

Wow!

I appreciate you Renea for this information. I feel more empowered with this information. Thank you for education me and other veterans on how to build and protect wealth even at my age.

The Personal Financial Checkup was an eye opener. I’ve already started implementing the strategies I learned and I am more confident and feel more secure about my family’s future than ever before. It's never too late to set a plan in place.

— Maria L., Navy Veteran